Sustainable Investing: ESG Factors in Finance

Sustainable Investing: ESG Factors in Finance is a rapidly growing approach that considers environmental, social, and governance (ESG) criteria to generate long-term competitive financial returns and positive societal impact.

This section delves into the definition, historical context, and significance of sustainable investing.

Understanding ESG Factors

Environmental Factors: Environmental considerations encompass issues such as climate change, resource depletion, and pollution. Companies with eco-friendly practices and low carbon footprints are favored in sustainable investing.

Social Factors: Social factors encompass aspects related to human capital, labor practices, and community relations. Companies fostering diversity, promoting fair labor practices, and contributing to community development align with social sustainability goals.

Governance Factors: Governance factors pertain to corporate governance structures, executive compensation, and shareholder rights. Transparency, accountability, and ethical leadership are crucial elements evaluated under governance criteria.

Integration of ESG in Finance

ESG Integration in Investment Strategies: ESG integration involves incorporating ESG factors into traditional financial analysis to assess investment risks and opportunities more comprehensively. This approach aims to enhance risk-adjusted returns and promote sustainable business practices.

ESG Metrics and Reporting: Measuring and reporting ESG performance metrics are essential for investors to evaluate companies’ sustainability efforts accurately. Standardized ESG reporting frameworks facilitate transparency and comparability among companies.

Benefits of Sustainable Investing

Financial Performance: Numerous studies have indicated a positive correlation between ESG performance and financial returns. Companies with strong sustainability practices tend to exhibit better long-term financial performance and resilience to market volatility.

Risk Management: Sustainable investing emphasizes risk mitigation by considering ESG factors that may impact a company’s reputation, regulatory compliance, and operational efficiency. Integrating ESG criteria helps investors identify and mitigate potential risks proactively.

Positive Social Impact: Beyond financial gains, sustainable investing contributes to positive social outcomes by supporting companies that prioritize environmental stewardship, social equity, and ethical governance. Investors can align their capital with their values and contribute to building a more sustainable future.

Challenges and Criticisms

Data Quality and Availability: One of the primary challenges in sustainable investing is the lack of standardized ESG data and metrics, making it challenging for investors to assess companies’ sustainability performance accurately.

Greenwashing Concerns: Greenwashing refers to the practice of misleadingly portraying a company’s environmental efforts to appear more sustainable than they are. Identifying genuine sustainable investments amidst greenwashing remains a challenge for investors.

Investor Education: Effective sustainable investing requires investors to understand complex ESG issues, investment strategies, and impact measurement methodologies. Improving investor education and awareness is essential for promoting sustainable investment practices.

Case Studies

Successful Implementation: Several companies have successfully integrated ESG considerations into their business models, achieving both financial success and positive societal impact. Case studies illustrate best practices and outcomes of sustainable investing initiatives.

Impact Assessment: Measuring the real-world impact of sustainable investing is crucial for evaluating its effectiveness and informing investment decisions. Impact assessment methodologies assess environmental, social, and governance outcomes to ensure investments align with sustainability goals.

Future Trends in Sustainable Investing

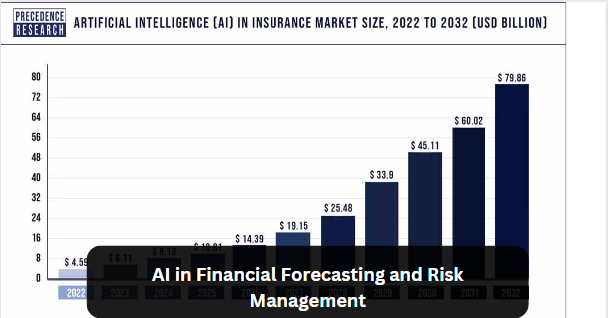

Growth Projections: The sustainable investing market is expected to continue its rapid growth trajectory, driven by increasing investor demand, regulatory developments, and societal awareness of sustainability issues.

Technological Advancements: Advancements in technology, such as artificial intelligence and big data analytics, are revolutionizing sustainable investing by improving ESG data quality, analysis capabilities, and impact measurement methodologies.

Regulatory Landscape

Current Regulations: Governments and regulatory bodies worldwide are implementing policies and regulations to promote sustainable finance, including ESG disclosure requirements, tax incentives, and green finance initiatives.

Potential Changes: Anticipated regulatory changes may further shape the sustainable investing landscape, influencing investment strategies, disclosure standards, and market dynamics. Stay informed about evolving regulations to navigate the sustainable investing market effectively.

Conclusion

In conclusion, Sustainable Investing: ESG Factors in Finance offers a promising approach to aligning financial goals with environmental and social sustainability objectives. By integrating ESG considerations into investment decisions, investors can generate competitive financial returns while contributing to positive societal impact and building a more sustainable future.