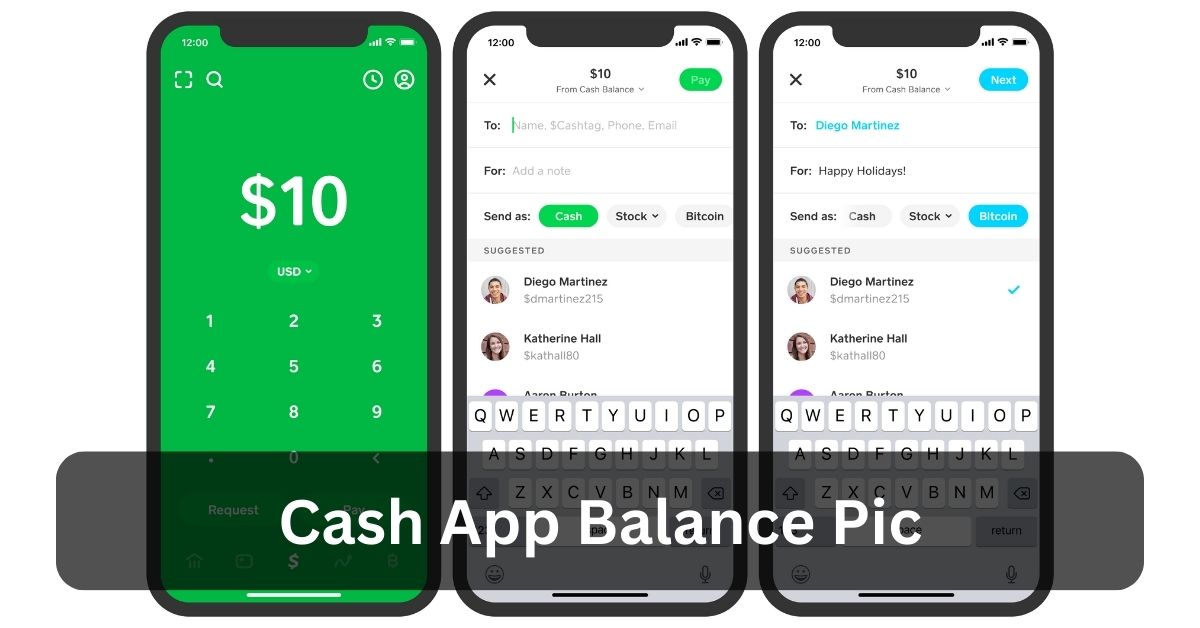

Cash App Balance Pic – The Ultimate Guide For You!

Cash App has emerged as a prominent player in digital finance, offering users a convenient platform for peer-to-peer payments, investing, and banking services.

One of the critical features of Cash App is its balance, which serves as the central hub for managing funds within the app.

This comprehensive guide delves into the nuances of the Cash App balance, exploring its significance, functionalities, and how users can effectively leverage it to navigate their financial transactions.

Understanding Cash App Balance – Here To Know!

At its core, the Cash App balance symbolizes the available funds within the Cash App ecosystem, serving as a digital wallet for users to consolidate funds from diverse sources, such as peer-to-peer payments, direct deposits, and transactions via the Cash App Cash Card.

Typically denominated in the user’s preferred currency, notably USD for those in the United States, this balance is a pivotal element in facilitating seamless financial transactions and managing personal finances within the Cash App platform.

Empowering users with flexibility and convenience, the Cash App balance embodies a digital repository where monetary transactions converge, providing users with a centralized hub to oversee their financial activities.

Whether receiving payments from friends, accessing direct deposits, or utilizing the Cash Card for purchases, the balance streamlines transactions and fosters financial autonomy by offering a comprehensive overview of available funds and facilitating swift, hassle-free money management within the Cash App ecosystem.

Key Features and Functionalities – Check Now!

The Cash App balance offers several features and functionalities that empower users to manage their finances efficiently:

Peer-to-Peer Payments:

Users can send and receive money directly from their Cash App balance to other Cash App users. This feature facilitates seamless transactions between friends, family, or even businesses.

Direct Deposits:

Cash App allows users to set up direct deposits, enabling them to receive paychecks, government benefits, and other payments directly into their Cash App balance. This feature eliminates the need for traditional bank accounts for those who prefer digital banking solutions.

Cash Card Transactions:

Cash App provides users with a customizable Cash Card linked to their Cash App balance. Users can use the Cash Card to make purchases online and in-store, withdraw cash from ATMs, and enjoy various cashback rewards.

Investing:

Cash App offers a feature called “Investing,” where users can use their Cash App balance to buy and sell stocks and Bitcoin. This feature gives users easy access to investment opportunities, allowing them to grow their wealth directly from their Cash App balance.

Bitcoin Transactions:

In addition to stocks, Cash App allows users to buy, sell, and transfer Bitcoin using their Cash App balance. This feature caters to users interested in cryptocurrency investments and further expands the utility of the Cash App balance.

Read Also: Yt.Be/Activate Code – Stream Smarter In 2024!

Managing Your Cash App Balance – Everything To Know!

Effective management of the Cash App balance is crucial for maintaining financial stability and maximizing the benefits offered by the platform. Here are some tips for managing your Cash App balance:

Monitor Transactions:

Regularly review your transaction history to track incoming and outgoing funds from your Cash App balance. This helps you stay informed about your spending patterns and identify any unauthorized or suspicious transactions.

Set Budgets and Goals:

Establish budgetary limits and savings goals to ensure responsible spending and saving habits. Use features like the Cash App Boosts to avail discounts and cashback rewards on eligible transactions, optimizing your spending.

Enable Security Features:

Take advantage of Cash App’s security features, such as Touch ID or Face ID authentication and two-factor authentication (2FA), to safeguard your account and prevent unauthorized access to your Cash App balance.

Link External Accounts:

Consider linking your traditional bank account or debit card to your Cash App account for flexibility in managing your funds. This allows you to seamlessly transfer money between your Cash App balance and external accounts.

Stay Informed:

Stay updated with Cash App’s terms of service, fee structure, and any policy changes to ensure compliance and avoid unexpected charges or disruptions to your account.

Read Also:Amazon.Com/My TV – The Ultimate Guide For You!

The Future of Cash App Balance – Discuss About It!

As Cash App continues to evolve and innovate in the digital finance space, the future of the Cash App balance holds immense potential for further enhancements and integrations.

With advancements in technology and the growing demand for seamless financial solutions, Cash App is poised to introduce new features and functionalities that cater to the evolving needs of users worldwide.

These enhancements may include improved security measures, expanded investment options, and enhanced user customization.

Additionally, Cash App may explore partnerships and integrations with other financial platforms to offer a more comprehensive suite of services, empowering users to manage their finances more efficiently and effectively in an increasingly digital world.

Conclusion:

An integral facet of Cash App’s functionality lies in its balance, which serves as the central nexus for overseeing financial transactions and resources within the application.

FAQs

How can I add funds to my Cash App balance?

You can add funds to your Cash App balance by linking your bank account or debit card and initiating a transfer.

Can I transfer my Cash App balance to my bank account?

Yes, you can transfer funds from your Cash App balance to your linked bank account easily within the app.

Are there any fees associated with maintaining a Cash App balance?

Cash App does not charge any fees for maintaining a balance, but there may be fees for certain transactions or services.

Can I use my Cash App balance to make purchases?

Yes, you can use your Cash App balance to make purchases online, in-store with your Cash Card, and send money to friends or family.

Is my Cash App balance protected against unauthorized transactions?

Cash App employs security measures to protect your balance, including encryption and fraud detection systems, to safeguard against unauthorized access and transactions.

Can I check my Cash App balance from my mobile device?

Yes, you can easily check your Cash App balance from your mobile device by opening the Cash App and accessing the balance section of the app interface.

Read Also: