AI in Financial Forecasting and Risk Management

In today’s rapidly evolving financial landscape, staying ahead of market trends and mitigating risks is paramount for businesses and investors alike. Enter artificial intelligence (AI), a game-changer in Financial Forecasting and Risk Management.

This article delves deep into the realm of AI, unveiling its pivotal role in revolutionizing traditional practices, enhancing decision-making processes, and driving unprecedented efficiency and accuracy.

The Evolution of AI in Financial Forecasting and Risk Management

Embark on a journey through the evolution of AI in Financial Forecasting and Risk Management, from its nascent stages to its current state of prominence.

Explore the historical milestones, technological advancements, and paradigm shifts that have propelled AI to the forefront of financial analysis and risk assessment.

Pioneering Innovations in AI Integration

Delve into pioneering innovations that have paved the way for seamless integration of AI technologies into financial forecasting and risk management frameworks. From machine learning algorithms to natural language processing capabilities, uncover the diverse array of AI tools reshaping the financial landscape.

Understanding the Mechanics of AI-powered Forecasting

Unlock the inner workings of AI-powered forecasting mechanisms, unraveling the complex algorithms and predictive models that underpin its efficacy. Gain insights into how AI leverages vast datasets, real-time market signals, and sophisticated analytical techniques to generate actionable forecasts with unparalleled precision.

Navigating Risk with AI-driven Insights

Navigate the intricate landscape of risk management with AI-driven insights that transcend conventional methodologies. Explore how AI algorithms analyze market volatility, detect emerging threats, and formulate adaptive strategies to mitigate risks and capitalize on opportunities, empowering businesses to thrive in uncertain times.

Maximizing Returns through AI Optimization Strategies

Discover how AI optimization strategies are reshaping investment paradigms, enabling stakeholders to maximize returns and minimize exposure to risk. From portfolio optimization to asset allocation, witness firsthand how AI algorithms optimize investment decisions, driving sustainable growth and resilience in dynamic market environments.

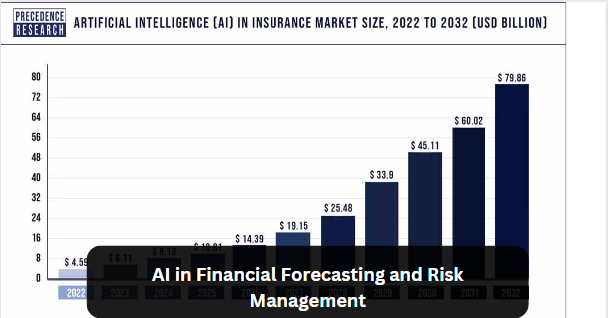

The Future Frontier of AI in Financial Forecasting and Risk Management

Peer into the future frontier of AI in Financial Forecasting and Risk Management, where innovation knows no bounds and possibilities are limitless. Explore emerging trends, disruptive technologies, and transformative applications poised to redefine the future of finance, ushering in a new era of prosperity and opportunity.

FAQs

How does AI enhance financial forecasting accuracy?

AI enhances financial forecasting accuracy by analyzing vast datasets, identifying intricate patterns, and adapting to evolving market dynamics in real-time. By leveraging advanced algorithms and predictive modeling techniques, AI generates actionable insights that empower stakeholders to make informed decisions with confidence.

What are the primary benefits of AI in risk management?

The primary benefits of AI in risk management include enhanced risk identification, proactive threat detection, and adaptive risk mitigation strategies. AI algorithms enable organizations to anticipate and respond to emerging risks swiftly, thereby safeguarding assets, preserving shareholder value, and fostering sustainable growth.

Can AI predict market trends accurately?

While AI can predict market trends with a high degree of accuracy, it’s essential to acknowledge the inherent uncertainty and volatility of financial markets. AI algorithms analyze historical data, macroeconomic indicators, and sentiment analysis to forecast market trends, but unforeseen events and market fluctuations can impact the accuracy of predictions.

How does AI optimize investment portfolios?

AI optimizes investment portfolios by leveraging advanced algorithms to allocate assets strategically, diversify risk, and maximize returns. Through dynamic rebalancing, risk assessment, and performance monitoring, AI algorithms adapt investment strategies to align with changing market conditions and investor objectives.

What role does AI play in fraud detection and prevention?

AI plays a crucial role in fraud detection and prevention by analyzing transactional data, identifying anomalies, and detecting suspicious patterns indicative of fraudulent activity. Machine learning algorithms can detect fraudulent behavior in real-time, enabling organizations to mitigate risks, protect assets, and safeguard consumer trust.

Conclusion

In conclusion, AI represents a transformative force in Financial Forecasting and Risk Management, offering unparalleled insights, efficiencies, and opportunities for businesses and investors alike. As AI continues to evolve and proliferate across the financial landscape, embracing its potential is not just a competitive advantage but a strategic imperative for success in an increasingly complex and dynamic marketplace.