Payment Revision Needed On Amazon – The Ultimate Guide!

Amazon, the e-commerce giant, has transformed the way we shop and do business. With its vast marketplace and extensive reach, it has empowered countless sellers and entrepreneurs to thrive in the digital economy.

However, amidst its towering success, there are persistent concerns regarding its payment policies and structures. Many sellers have raised issues ranging from transparency to fairness in payments.

In this article, we delve into the intricacies of these concerns, explore the challenges faced by sellers, and propose solutions for a more equitable payment framework on Amazon.

The Current Landscape – Here To Know!

Amazon operates on a complex payment system, where sellers receive payouts based on various factors such as sales volume, product category, fulfillment method, and fee structures.

While this system aims to provide flexibility and cater to diverse business models, it often falls short in meeting the needs and expectations of sellers.

One of the primary concerns voiced by sellers is the lack of transparency in Amazon’s payment calculations. Many sellers find it challenging to understand how their payouts are calculated, leading to confusion and frustration.

The opacity surrounding fees, deductions, and reimbursements further exacerbates this issue, making it difficult for sellers to accurately forecast their earnings and manage their finances.

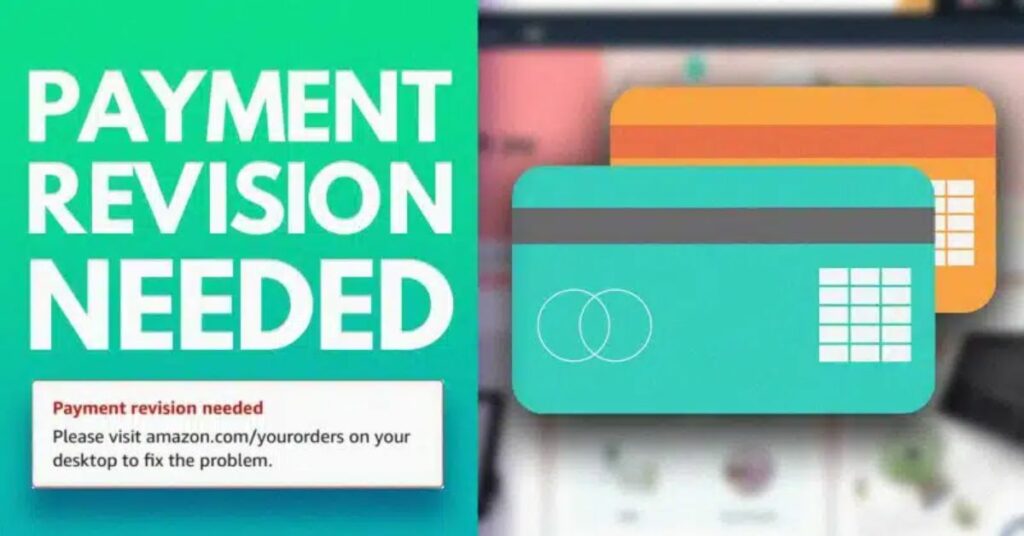

Moreover, sellers often encounter delays and inconsistencies in payments, with funds getting held up due to various reasons such as account reviews, policy violations, or technical glitches.

These delays not only disrupt cash flow but also hinder business operations and growth initiatives. Furthermore, sellers lament the disparity in payment terms between Amazon and other platforms.

While competitors offer more favorable terms such as faster payouts or lower transaction fees, Amazon’s payment structure is perceived as less favorable and sometimes burdensome for small and medium-sized sellers.

Challenges Faced by Sellers – Discover Now!

The challenges posed by Amazon’s payment system are manifold and impact sellers of all sizes and categories. Small businesses, in particular, face significant hurdles as they navigate the intricacies of Amazon’s marketplace while striving to remain financially viable.

1. Cash Flow Management:

Fluctuating sales volumes, coupled with unpredictable payment schedules, make it challenging for sellers to manage cash flow effectively.

This instability can impede inventory replenishment, hinder growth initiatives, and even jeopardize the survival of small businesses during lean periods.

2. Profitability Concerns:

The opaque nature of Amazon’s fee structures and payment calculations often results in sellers receiving less-than-expected payouts. This can erode profit margins and undermine the sustainability of businesses, especially those operating on narrow margins or competitive niches.

3. Compliance Burdens:

Amazon’s stringent policies and regulations add another layer of complexity for sellers, who must navigate a maze of rules to avoid penalties or account suspensions.

Payment-related issues such as chargebacks, returns, or claims further compound compliance burdens, diverting resources away from core business activities.

4. Trust and Reputation:

Payment delays or discrepancies can erode trust between sellers and Amazon, tarnishing the platform’s reputation and driving sellers to explore alternative marketplaces or channels.

Maintaining a positive seller experience is crucial for Amazon’s long-term success, making it imperative to address payment-related concerns promptly and effectively.

5. Proposed Solutions – Everything To Know!

Addressing the payment challenges on Amazon requires a multi-faceted approach that prioritizes transparency, reliability, and fairness for sellers. Here are some proposed solutions to enhance the payment experience and foster a more conducive environment for sellers:

6. Enhanced Transparency:

Amazon should provide clear and comprehensive explanations of payment calculations, including fees, deductions, and reimbursements.

Implementing detailed transaction reports and analytics tools can empower sellers to track their earnings more effectively and make informed decisions about their business strategies.

7. Streamlined Payment Processes:

Amazon should streamline payment processes to minimize delays and ensure timely disbursal of funds to sellers. This includes optimizing account verification procedures, expediting review processes, and leveraging technology to automate payment workflows wherever possible.

8. Flexible Payment Options:

Offering flexible payment options such as daily or weekly payouts can help alleviate cash flow concerns for sellers, especially during peak seasons or promotional events.

Additionally, exploring alternative payment methods or partnerships with financial institutions can provide sellers with more choices and convenience.

9. Fair Fee Structures:

Amazon should review its fee structures to ensure they align with the value provided to sellers and are competitive compared to other platforms.

This may involve revising commission rates, reducing fixed fees, or introducing tiered pricing models based on sales volume or performance metrics.

10. Proactive Support and Education:

Amazon should invest in proactive support initiatives and educational resources to help sellers navigate payment-related issues more effectively.

This includes providing dedicated account managers, hosting webinars or workshops, and offering self-service tools and guides on payment best practices.

11. Community Engagement:

Fostering a vibrant seller community where merchants can share insights, experiences, and best practices can help address payment concerns collaboratively.

Amazon should facilitate forums, discussion groups, and networking events to encourage peer-to-peer support and knowledge sharing among sellers.

Conclusion:

Amidst Amazon’s remarkable success, there persist concerns surrounding its payment policies and structures. Numerous sellers have voiced grievances spanning from transparency to equity in payments.

FAQs:

1. What are the common concerns regarding Amazon’s payment policies?

Many sellers express worries about transparency and fairness in Amazon’s payment structures, seeking clearer explanations and equitable treatment.

2. How does payment transparency impact sellers on Amazon?

Transparency is crucial for sellers to understand how their earnings are calculated, enabling better financial planning and informed decision-making.

3. What challenges do sellers face with Amazon’s payment delays?

Payment delays can disrupt cash flow, hinder inventory management, and impede growth opportunities for sellers, particularly small businesses.

4. Why is flexible payment options important for sellers on Amazon?

Flexible payment options, such as daily or weekly payouts, alleviate cash flow concerns, especially during peak seasons or promotional periods.

5. What measures can Amazon take to address payment-related issues?

Amazon can enhance transparency, streamline payment processes, and offer fair fee structures to improve the payment experience for sellers.

6. How does Amazon’s payment framework impact seller trust and reputation?

Payment discrepancies or delays can erode trust between sellers and Amazon, affecting the platform’s reputation and seller retention rates.

Read Also: